Inflation and world politics keep changing, which causes massive inflation. As an everyday citizen, day-to-day life is affected the hardest. These days, you always wish you had a stable side income to support when things get tough. While there are many financial options you can target, today we discuss Worthy Investments in this Worthy Bonds review.

Let's see whether the worthy bonds legit or not.

What Sets Worthy Investment Apart?

There are a few things in this Worthy Bonds review about Worthy Investments that set it apart from others. Here are these prime aspects:

- Worthy bonds are one of the few investment types that return a flat 5.5% interest rate on your investments.

- The minimum amount of bond you can start with is just $10.

- You can cash out your interest and savings any time you want and won't receive any penalty.

- Real estate bonds aren’t as liquid as other deals, but the cashout from Worthy makes it surprisingly liquid.

- Supports real estate developers with your investment to help them grow, in turn getting dividends from this investment.

Located in Boca Raton, FL, Worthy company has been successful since its start when it raised $600,000 in seed capital and has up to 65 Series licenses. Until now, the investment agent has been highly successful in providing $1.2 million in interest generated. Since their formation, this amount has been dispersed to more than 90,000 of their bondholders.

So, no matter how many other investment opportunities you see, we still recommend you at least invest a small amount here. With time, when you have generated enough profits from other scopes, you can invest more here. With regular 5% interest returns, you can sit back and relax to enjoy your earnings.

Worthy Bonds Review – How Does It Work?

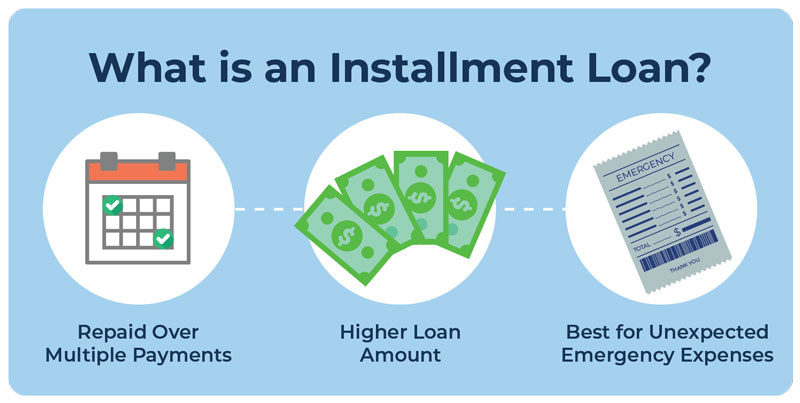

The Worthy Bonds working is quite simple. Whatever bonds you buy from them, no matter the amount, Worthy then invests in the total capital from these bonds. They give this amount to their registered real estate companies to invest in short-term projects and get interest on these loans. Worthy then shares a prescribed portion of these interests with its customers.

The best part about these bonds is that they are essentially ‘Demand’ bonds, so they do not require the buyer to wait for any maturity period. This also means that they can cash them whenever needed.

Most of the functions are available through their app, where you can buy the bonds and allow the app to update the investment feature, which is automated. You can also link your bank account information with the app, which allows for more streamlined recurring investments.

Finally, they are making profits on the bonds that consumers invest as loans to the real estate industry. As we said, while it shares a flat rate of 5% interest with you, it charges a much higher amount of interest to real estate projects and investors.

Worthy Bonds Review – Are Worthy Bonds Legit?

While the company isn’t registered as other banks or insured by FDIC, it works around this limitation by only investing in not more than 2/3rd of its borrower's business inventory. So if there is any issue of bankruptcy, they can get back their money’s worth.

Secondly, they invest some of the money loaned into secure investments such as U.S. Treasury securities and some others. This diversification allows them to be a safe investment, which quickly makes up to 40% of the value your bonds are worth when you invest here.

Worthy Bond Review – Most Promising Features

- This private bond business and money lending authority offer different accounts, such as personal, non-profit, and even business accounts.

- Their significant investment is bonds, especially for small businesses, but it also explores others from time to time to diversify how it can serve its customers better.

- You can start with a small investment of $10 and go up to a max of $50,000 a year, which is the limit they allow their customers because they don’t have insurance from FDIC.

- Easy access to their services via websites and mobile apps where you can easily access almost all their functions.

Worthy Bonds Review – Fees

As we shared above, because Worthy charges a higher amount of interest to their borrowers, they make money from that and other things. Most loans they provide are made by consumers buying their bonds. To facilitate them and bring in new customers, they don’t charge any fee. So much so that they don’t even charge you a monthly or joining fee. They also go above and beyond and won't charge you any transference fees.

The only time they will charge you is penalties, which only occur if you want to liquidate your bond without completing their 36-month period in certain circumstances.

Are There Any Alternatives to Worthy?

There are many different alternatives if you like to take some risks on your investment. You can directly invest in stocks and have good returns where you either trade yourself or hire a broker to do that for you.

Other companies also follow the 5% fixed rate interest route, which is still better than investing in a savings account. Finally, certain platforms allow you to invest in startups and businesses through them. This investment is a bit risky but can rack you up to 20% in interest. In the end, it is up to you to choose great alternatives.

Worthy Bonds Review – Final Words

there are many ways to make side income when investing, and most individuals will go for savings accounts as they deem them safe. On the basis of interest rates and returns alone, Worthy seems to be doing a great job.

Worthy, being a secure source of income through investment is a great option. It can be part of a more extensive portfolio where it returns constant and stable income. You can use this earned income and plan to invest in other more lucrative yet riskier income.

As a final recommendation, you can always start small and slowly increase your investment.